19/03/2023

The UK will avoid a recession this year, according to a string of City analysts who changed their gloomy predictions after the economy returned to growth in January.

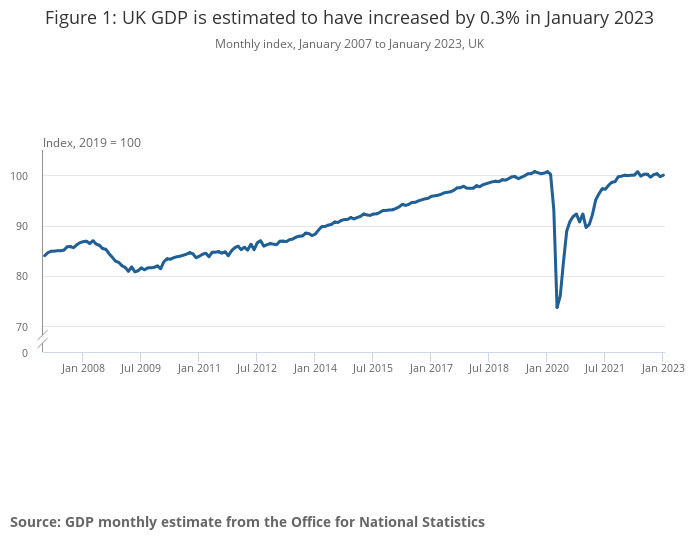

As Jeremy Hunt prepares to deliver his maiden Budget next week, the Office for National Statistics (ONS) said the economy expanded 0.3pc in January after shrinking by 0.5pc in a December marred by strikes.

While output in January was also hit by walkouts, statisticians said the rebound was helped by children returning to classrooms following “unusually high absences” in the run-up to Christmas, as well as the Premier League returning to its normal schedule following December's World Cup in Qatar.

Darren Morgan, ONS director for economic statistics, said the end of postal strikes also helped to boost output, though the rise in activity was partly offset by a “notable” drop in construction, including infrastructure projects. January's rebound was driven entirely by Britain's dominant services sector, as manufacturing also suffered a decline.

However, closely-watched survey data for February suggest the recovery could be sustained, as services continue to outperform. Growth in January was above expectations for the UK to eke out an expansion of just 0.1pc, prompting several City analysts to ditch their forecasts for a prolonged period of decline.

Goldman Sachs said it no longer expects the UK to slide into a technical recession – defined as two straight quarters of falling output – at the start of 2023.

Economists at the US investment bank said survey data for February pointed to continued momentum, meaning it no longer believed the economy would shrink by 0.4pc in the first three months of the year, and would instead flatline.

The positive performance also prompted Deutsche Bank to remove its recession forecast, while analysts at Citi also said survey data suggested the UK was on course to expand rather than shrink at the start of 2023. “We see further upside risks ahead here as public sector strike action was wound down,” said Benjamin Nabarro, an economist at Citi. JP Morgan said as early as last month that the UK would dodge a recession.

The Bank of England's current forecasts show the UK economy is on course to keep shrinking for more than a year, although most economists believe any recession will be mild and short-lived.

The Chancellor said the economy had “proved more resilient than many expected”, which will reignite calls for more tax cuts in next week's Budget.

However, Mr Hunt warned that “there is a long way to go”.

Commenting on the GDP figures, Mr Hunt said: “Next week, I will set out the next stage of our plan to halve inflation, reduce debt and grow the economy – so we can improve living standards for everyone.”

Mr Hunt is expected to extend a £2,500 cap on energy bills for three months, which will help to shore up incomes and lower headline inflation alongside a fresh package of help for those on the lowest incomes. However, most economists expect the economy to remain smaller than its pre-pandemic size until at least 2024.

Original Article: The Telegraph

Are you an employer or organisation that needs to hire talent in Wales? Contact our digital recruitment specialist Gareth Allison on 02920 628808.

Guiding you through your career, turning one stone at a time. Browse the latest Jobs in Wales.